Automotive Interior Components/Accessories Market Size, Share, Growth Analysis Report - Forecast 2034

Automotive Interior Components/Accessories Market By Product Type (Center Stack, Head-Up Display, Instrument Cluster, Rear Seat Entertainment, Dome Module, Headliner, Seat, Interior Lighting, Door Panel, Adhesives & Tapes, and Others), By Material (Leather, Fabric, Vinyl, Wood, Glass Fiber Composite, Carbon Fiber Composite, Metal, and Others), By Vehicle Type (Passenger Cars, Light Commercial Vehicles, and Heavy Commercial Vehicles), By End-market (OEM, Aftermarket), and By Region: Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

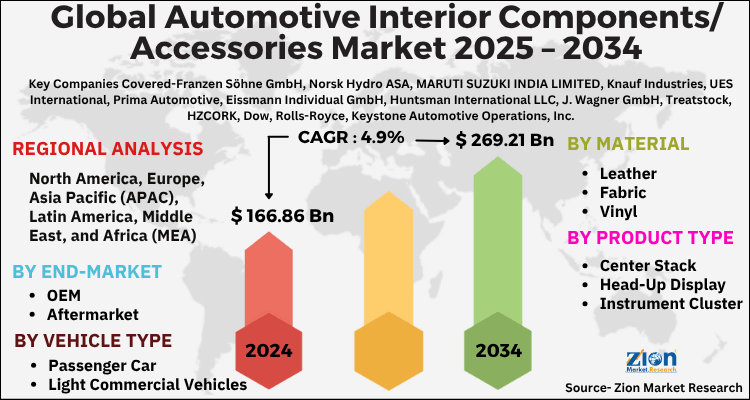

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 166.86 Billion | USD 269.21 Billion | 4.9% | 2024 |

Automotive Interior Components/Accessories Market: Industry Perspective

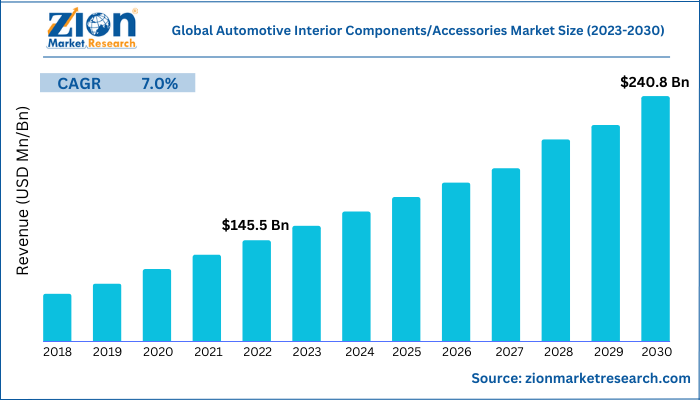

The global automotive interior components/accessories market size was worth around USD 166.86 Billion in 2024 and is predicted to grow to around USD 269.21 Billion by 2034 with a compound annual growth rate (CAGR) of roughly 4.9% between 2025 and 2034. The report analyzes the global automotive interior components/accessories market's drivers, restraints/challenges, and the effect they have on the demands during the projection period. In addition, the report explores emerging opportunities in the automotive interior components/accessories industry.

Automotive Interior Components/Accessories Market: Overview

Accessories and supplemental products for the interior of cars are used for ease, aesthetics, safety, and other purposes. The seats, dashboards, cockpit, and door panels are referred to as the vehicle's internal accessories. As the population's preference for aesthetic appeal increases, the popularity of automotive interiors is rising. This has an impact on the sale of passenger vehicles. When choosing such cars, the buyer also offers the safety of life and more weight. Expensive premium and luxury cars fall into the group of vehicles with exceptional interiors and build quality.

Key Insights

- As per the analysis shared by our research analyst, the global automotive interior components/accessories market is estimated to grow annually at a CAGR of around 4.9% over the forecast period (2025-2034).

- Regarding revenue, the global automotive interior components/accessories market size was valued at around USD 166.86 billion in 2024 and is projected to reach USD 269.21 billion by 2034.

- The automotive interior components/accessories market is projected to grow at a significant rate due to rising demand for comfort, luxury, and customization in vehicles, along with advancements in smart and connected interior technologies.

- Based on the product type, the seat segment is expected to dominate the market over the forecast period.

- Based on the material, the leather segment is expected to grow significantly during the forecast period.

- Based on region, the Asia Pacific is expected to capture the largest market share during the forecast period.

Automotive Interior Components/Accessories Market: Growth Drivers

Increasing demand for luxury vehicles drives the market growth

Future market expansion is anticipated to be fueled by rising demand for premium cars. Luxury cars are referred to as having high-end features that go above and beyond the basic requirements. Due to the use of automotive interiors, these vehicles have more opulent interiors, better performance capabilities, and the newest safety and technological features. For instance, the Federation of Automotive Dealers Associations, an automotive association with headquarters in India, reports that in India during the first 12 months of 2021, 24,009 luxury cars were sold, representing an increase in sales of 45% over the same period in 2020. Additionally, India saw a 142% increase year over year for Italian automaker Lamborghini. As a result, the automotive interior components/accessories industry is expanding as a result of rising luxury vehicle demand.

Automotive Interior Components/Accessories Market: Restraints

The presence of low-quality interior car accessories impedes the market growth

Numerous low-quality suppliers of interior vehicle accessories are readily available in the global automotive interior components/accessories market. When compared to branded interior car accessories, these goods are provided at competitive prices. Consumers are buying low-quality interior accessories despite the inferior quality provided and the appealing appearance. Over the forecast period, the market's development is anticipated to be constrained by consumers' low knowledge of genuine accessories.

Automotive Interior Components/Accessories Market: Opportunities

Growing innovative product launches offers an attractive opportunity

The easy-return seat feature has become a major trend in the market for automotive interior parts and accessories. To maintain their market share, major players in the automotive interior industry are launching novel products. For instance, a driver's easy return seat feature that allows a comfortable ride for small passengers was created by Toyota Boshoku Corporation, a Japanese auto component manufacturer, in February 2020. Every time they enter and leave the seat, it makes it easier to adjust the seat's position. The Toyota Yaris, their newest model, has this seat feature.

Automotive Interior Components/Accessories Market: Challenges

An increase in trade tariffs poses a major challenge

Due to the increase in import tariffs, there is growing unpredictability in international trade. The US government recently imposed a section 301 tariff with a 10% duty that increased to a 25% duty starting in January 2019 on automotive components sourced from China. Thus, this is expected to pose a major challenge to the automotive interior components/accessories industry market expansion.

Automotive Interior Components/Accessories Market: Segmentation

The global automotive interior components/accessories industry is segmented based on product type, material, vehicle type, end-market, and region.

Based on the product type, the global market is bifurcated into the center stack, head-up display, instrument cluster, rear seat entertainment, dome module, headliner, seat, interior lighting, door panel, adhesives & tapes, and others. The seat segment is expected to dominate the market over the forecast period. The increase in the segment is attributed to rising luxury and comfort demand as well as rising vehicle production. In terms of the driving and passenger experience, the Seat is crucial.

Technologies that enable intelligent seating adjustment, adaptable comfort, and an abundance of other features have been acquired by new companies. For instance, Faurecia has developed seat cover-specific Cover Carving Technologies. The Renault Talisman sedan now offers 3 centimeters more knee space for rear passengers due to the technology that has been integrated into it. The Active Wellness 2.0 seat idea is one of Faurecia's additional new technologies. Many biological and behavioral data points are covered by this technology, including pulse rate, respiration rate, humidity, blinking, head tilting, and others. It allows the seat to monitor the physical and mental health of the driver and other passengers and take proactive steps to reduce stress and sleepiness.

Based on vehicle type, the market is segregated into passenger cars, light commercial vehicles, and heavy commercial vehicles.

Based on the material, the global automotive interior components/accessories industry is segmented into leather, fabric, vinyl, wood, glass fiber composite, carbon fiber composite, metal, and others. The leather segment is expected to grow significantly during the forecast period. This is attributed to the appealing properties of the leather. Leather is the priciest material, and it takes a lot longer to stitch and trim than fabric. As a result of its affordability, aesthetic appeal, and other advantages, artificial leather is increasingly being used by car manufacturers. Over the projection period, this is anticipated to increase demand for synthetic leather. On the other hand, the fabric segment is growing at a steady rate during the project period. Interiors made of fabric are regarded as cozy and beautiful. Wool is a common material used in car upholstery because it is adaptable and long-lasting. Wool's ability to be dyed and woven into any texture has increased its use in seat and door panels, providing this market with huge growth potential. Thus, driving segmental growth.

Recent Developments:

- In March 2021, M&N Plastics Company was acquired by Lear Corporation, a US-based manufacturer of automotive seating and electrical components. In addition to producing complex electrical distribution parts like high-voltage wire harnesses and power electronics, the acquisition will probably exceed customer expectations. Custom plastic injection model products and engineered plastic components for automotive electrical distribution uses are both produced by the US-based M & N Plastics Company.

- In October 2022, to market their freshly created In-vehicle Infotainment (IVI) platform for sale to independent automakers, Hyundai Mobis and Luxoft announced a new agreement. The Mobis Infotainment System (MIS), which was created by both companies, is an IVI platform that can completely control six displays, including a digital cluster, an augmented reality heads-up display, a center stack display, and three displays for the passenger seats. In October 2022, the International Suppliers Fair was held in Germany, and it was revealed there.

- In February 2022, Microsoft and Harman International, a Samsung Electronics company, announced a partnership to combine Harman International products from its Digital Transformation Solutions (DTS) business with Microsoft Azure Private Multi-access Edge Compute (PMEC).

- In November 2022, for the next generation of Renault vehicles, Qaulcomm Technologies Inc. and Renault SA collaborated to create high-performance digital platforms. In line with this arrangement, Qualcomm will provide its Snapdragon digital chassis to enable connectivity, ADAS, and digital cockpit in the upcoming Renault vehicles.

Automotive Interior Components/Accessories Market Report Scope:

| Report Attributes | Report Details |

|---|---|

| Report Name | Automotive Interior Components/Accessories Market |

| Market Size in 2024 | USD 166.86 Billion |

| Market Forecast in 2034 | USD 269.21 Billion |

| Growth Rate | CAGR of 4.9% |

| Number of Pages | 201 |

| Key Companies Covered | Franzen Söhne GmbH, Norsk Hydro ASA, MARUTI SUZUKI INDIA LIMITED, Knauf Industries, UES International, Prima Automotive, Eissmann Individual GmbH, Huntsman International LLC, J. Wagner GmbH, Treatstock, HZCORK, Dow, Rolls-Royce, Keystone Automotive Operations, Inc., Kuda UK LTD, MOBIS INDIA LIMITED, Polydesign Systems, Adient PLC, Grupo Antolin, Panasonic Corporation, Faurecia, Lear Corporation, Continental AG, Denso Corporation, Harman International Industries Inc., Robert Bosch GmbH and Alpine Company, among others. |

| Segments Covered | By Product Type, By Material, By Vehicle Type, By End-market, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, The Middle East and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2020 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Automotive Interior Components/Accessories Market: Regional Analysis

Asia Pacific is expected to capture the largest market share during the forecast period

The Asia Pacific is expected to dominate the global automotive interior components/accessories market during the forecast period, owing to rapid growth in the automotive industries and the increasing disposable income of the population, particularly in India and China. According to Invest India, currently, the Indian automotive sector accounts for 49% of India's manufacturing GDP and 7.1% of the country's overall GDP. Between 2022 and 2030, the EV market is anticipated to expand at a CAGR of 49%, reaching annual sales of 10 million units by 2030. By 2030, the EV sector will generate 50 million direct and indirect jobs.

Similarly, in both yearly sales and manufacturing output, China continues to be the world's biggest market for automobiles. By 2025, domestic production is anticipated to reach 35 million automobiles. According to information from the Ministry of Industry and Information Technology, more than 25 million vehicles, including 19.99 million passenger cars, were delivered in 2020, a 6.5% decrease from 2019. Sales of commercial vehicles increased by 20% from 2019 to 5.23 million units. Moreover, the significant presence of automobile accessory OEMs, the high sales of connected cars as a result of young, millionaire car buyers' preferences for connectivity features in vehicles, the widespread use of smartphones, the rising Internet penetration, and the increasing sales of electric and autonomous vehicles.

The demand for infotainment systems is being driven by the transition from basic audio systems to touchscreen infotainment systems that support a variety of functions, including navigation, Apple CarPlay, Android Auto, Telematics, etc. Infotainment systems are also being driven by nations like India and China. Previously, a vehicle's infotainment system was only available on the highest-end model. Even in mid- and entry-level trims, infotainment devices are currently available from OEMs. Additionally, China's road infrastructure is expanding, making navigation a requirement in almost all vehicles. For instance, Nio Inc. introduced the ES7 sports utility vehicle in China in June 2022. It has a multimedia system with a 23-speaker surround-sound setup. Thus, this is expected to drive market growth in the region.

Automotive Interior Components/Accessories Market: Competitive Analysis

The report provides a company market share analysis to give a broader overview of the key market players. In addition, the report also covers key strategic developments of the market, including acquisitions & mergers, new product launches, agreements, partnerships, collaborations & joint ventures, research & development, and regional expansion of major participants involved in the automotive interior components/accessories market on a global and regional basis.

The global automotive interior components/accessories market is dominated by players like:

- Franzen Söhne GmbH

- Norsk Hydro ASA

- MARUTI SUZUKI INDIA LIMITED

- Knauf Industries

- UES International

- Prima Automotive

- Eissmann Individual GmbH

- Huntsman International LLC

- J. Wagner GmbH

- Treatstock

- HZCORK

- Dow

- Rolls-Royce

- Keystone Automotive Operations Inc.

- Kuda UK LTD

- MOBIS INDIA LIMITED

- Polydesign Systems

- Adient PLC

- Grupo Antolin

- Panasonic Corporation

- Faurecia

- Lear Corporation

- Continental AG

- Denso Corporation

- Harman International Industries Inc.

- Robert Bosch GmbH and Alpine Company

The global automotive interior components/accessories market is segmented as follows:

By Product Type

- Center Stack

- Head-Up Display

- Instrument Cluster

- Rear Seat Entertainment

- Dome Module

- Headliner

- Seat

- Interior Lighting

- Door Panel

- Adhesives & Tapes

- Others

By Material

- Leather

- Fabric

- Vinyl

- Wood

- Glass Fiber Composite

- Carbon Fiber Composite

- Metal

- Others

By Vehicle Type

- Passenger Car

- Light Commercial Vehicles

- Heavy Commercial Vehicles

By End-market

- OEM

- Aftermarket

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Automotive interior components/accessories are supplementary devices in automobiles for purposes such as safety, appeal, convenience, and others. These interior accessories in the vehicle are referred to as the seats, dashboards, cockpit, and door panels. Automotive interiors are increasingly gaining popularity, as the population is a highly preferred visual appearance, which influences the sale of passenger cars.

The global automotive interior components/accessories market is expected to grow due to rising demand for comfort, luxury, and customization in vehicles, along with advancements in smart and connected interior technologies.

According to a study, the global automotive interior components/accessories market size was worth around USD 166.86 Billion in 2024 and is expected to reach USD 269.21 Billion by 2034.

The global automotive interior components/accessories market is expected to grow at a CAGR of 4.9% during the forecast period.

Asia-Pacific is expected to dominate the automotive interior components/accessories market over the forecast period.

Which are the major players leveraging the automotive interior components/accessories market growth?

Leading players in the global automotive interior components/accessories market include Franzen Söhne GmbH, Norsk Hydro ASA, MARUTI SUZUKI INDIA LIMITED, Knauf Industries, UES International, Prima Automotive, Eissmann Individual GmbH, Huntsman International LLC, J. Wagner GmbH, Treatstock, HZCORK, Dow, Rolls-Royce, Keystone Automotive Operations, Inc., Kuda UK LTD, MOBIS INDIA LIMITED, Polydesign Systems, Adient PLC, Grupo Antolin, Panasonic Corporation, Faurecia, Lear Corporation, Continental AG, Denso Corporation, Harman International Industries Inc., Robert Bosch GmbH and Alpine Company among others., among others.

The report explores crucial aspects of the automotive interior components/accessories market, including a detailed discussion of existing growth factors and restraints, while also examining future growth opportunities and challenges that impact the market.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed